What is Stripe and How Can It Help Your Business?

By

|

Last updated on

Do you want to know what Stripe is and how it can help your business?

Stripe is a payment service provider that lets businesses of all sizes accept online payments. It processes payments securely, and then transfers the balance to your bank account.

In this article, we’ll take a deep dive into Stripe and how you can leverage its features to increase sales and grow your business.

In This Article

What is Stripe?

Stripe is a popular payment processor that allows online businesses to accept one-time and recurring payments made with credit and debit cards, as well as digital wallets, and bank transfers.

It has quickly evolved into a comprehensive payment processing system that offers a credit card payment gateway in addition to superior fraud protection features and advanced reporting.

Both, small and large businesses, use Stripe to accept payments online and manage their finances using their Stripe dashboard.

How Does Stripe Work?

Stripe makes it easy for businesses to receive online payments via several different payment method options and currencies.

Currently, it supports 13+ payment methods, including traditional credit and debit cards, ACH Direct Debit, digital wallets (Apple Pay, Google Pay, Microsoft Pay, Cash App, GrabPay), Buy Now, Pay Later services, Alipay, Bacs Direct Debit, SEPA Direct Debit, and more.

By offering multiple payment method options to your customers, you can easily increase conversion rates. In addition, Stripe allows you to accept payments in over 135 different currencies, making it ideal for online businesses that sell internationally as well.

It’s also a PCI Level 1 provider, which means that it meets the digital payment processing security standards set forth by the Security Standards Council. While some of the other payment processors require you to take on the burden of becoming PCI-compliant, Stripe takes care of it for you. It uses a unique string of code called a token that allows you to charge a customer’s card without storing the payment details.

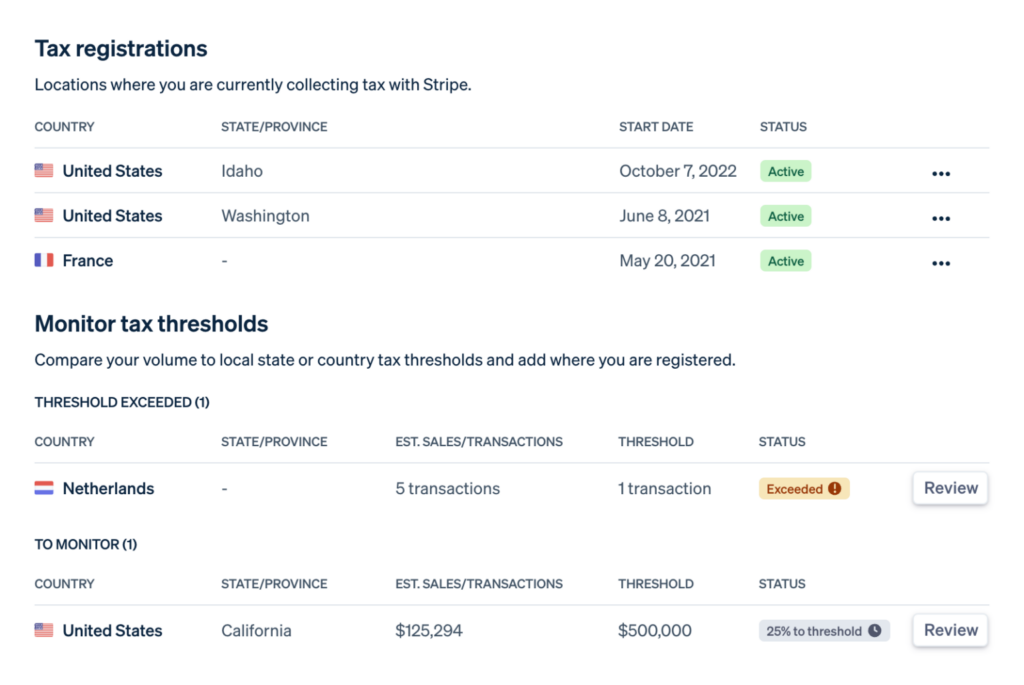

Stripe Tax

Stripe Tax is a premium Stripe feature that lets you enable automatic tax collection. It also allows you to easily add a tax registration and monitor your tax obligations to ensure that you’re staying compliant depending on your location.

Once you’ve registered your business with Stripe, you can get an overview of the locations you collect taxes from.

Security Features

Stripe offers advanced security features that you can easily customize to protect your business from fraud.

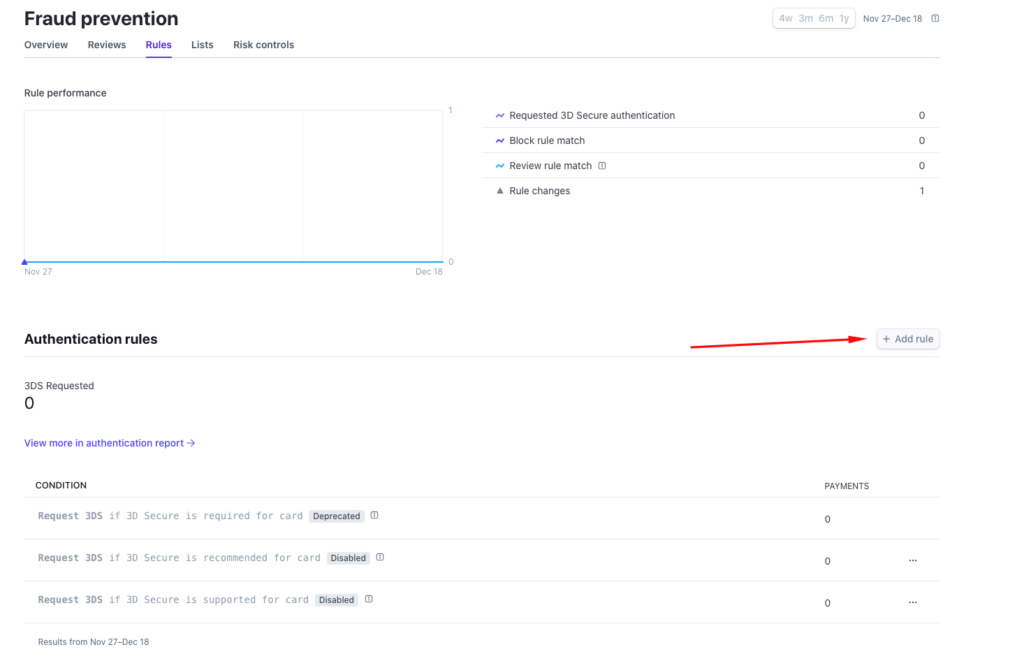

Stripe Radar allows you to customize your own fraud protection rules to automatically allow or block charges based on transaction details.

All you need to do is log in to your Stripe dashboard to set up your rules. Simply click on the Add rule button to edit your settings. You can easily make changes to your fraud and risk rules at any time as you monitor transaction activity.

Stripe also makes it easy to manage payment disputes and chargebacks.

Simply navigate to the Payments tab in the dashboard to access a list of all transactions, including any disputes.

WP Simple Pay and Stripe

Connecting your Stripe account to WP Simple Pay, the #1 Stripe payments plugin for WordPress, is easy and allows you to accept payments on your WordPress site without setting up a shopping cart. The plugin also lets you create the perfect payment forms in minutes without having to write a single line of code.

You can use WP Simple Pay to conveniently manage most of your Stripe settings directly from your WordPress admin dashboard, saving you from having to log in to your Stripe dashboard regularly.

For example, it offers an Activity and Reports dashboard that provides you with an overview of the Stripe payments you’ve received, the payment methods used, and additional customer information.

When it comes to collecting taxes, WP Simple Pay lets you create payment forms that collect fixed-rate tax amounts and forms that use automatic Stripe tax collection, depending on your needs.

See our detailed guide on how to collect taxes for Stripe payments in WordPress.

With WP Simple Pay, you can choose between an on-site payment form and an off-site Stripe Checkout page. Each form type has its own set of advantages.

On-site payment forms allow your customers to complete their payments without ever leaving your site. This is a proven way to increase conversion rates because it involves less friction and requires fewer steps for your customers.

However, a Stripe-hosted checkout page is more appropriate for specific businesses and organizations that only want to embed a Pay Now button on their site. Once customers click on the button, they are redirected to a secure page to complete their transaction.

To learn more about the different payment form types, see our full guide: Payment Form Types: Embedded vs. Overlay vs. Stripe Checkout.

Processing Fees

Other than a per-transaction fee, Stripe doesn’t charge additional fees for you to receive payments. It doesn’t have monthly fees, or setup fees like some of the other payment processors.

For most businesses based in the United States, the standard processing fee for credit cards, debit cards, Apple Pay, and Google Pay is just 2.9% plus 30 cents per transaction. Per-transaction processing fees are automatically deducted from your payout balance.

Using WP Simple Pay, you can even eliminate the Stripe processing fee by passing it on to your customers.

Remove the additional 3% fee!

Most Stripe plugins charge an additional 3% fee for EVERY transaction

…not WP Simple Pay Pro!

We hope this article has helped you learn more about Stripe and how you can use it along with WP Simple Pay to easily and securely accept online payments.

If you liked this article, you might also want to check out our guides on why Stripe is the best payment processor and how to get Stripe payment reports in WordPress.

What are you waiting for? Get started with WP Simple Pay today!

To read more articles like this, follow us on Facebook and Twitter.