What Is Stripe Radar and How to Use It the Right Way?

By

|

Last updated on

Have you ever heard of Stripe Radar?

It’s a Stripe tool to protect your business from fraud.

Since its inception, Radar has blocked billions of dollars in fraud across the Stripe network for companies of all sizes.

If you accept payments online via Stripe and want to know more about Stripe Radar, you’re at the right place.

In this article, we’ll explain what Stripe Radar is and how to use it.

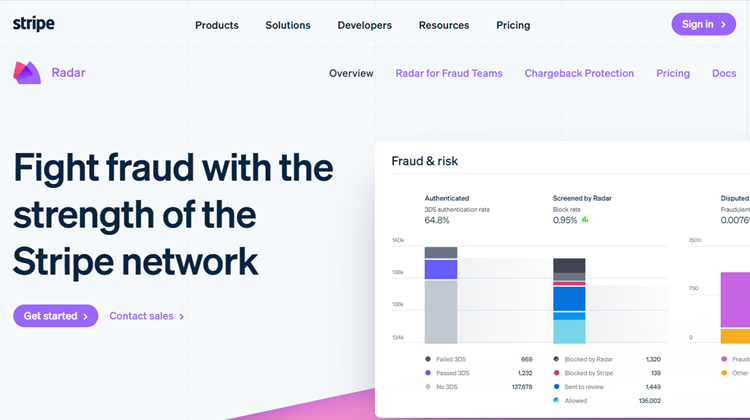

What Is Stripe Radar?

Stripe Radar is a tool that comes built-in with all Stripe accounts to protect your business from fraud.

When most payment processors recognize fraud, they often simply block the payment without letting you know why it did so. With Radar, Stripe wants you to get more control over what kind of payments get blocked and what gets accepted on your website.

In other words, Radar is a machine learning detection algorithm that identifies fraudulent activity on payments that take place on Stripe’s platform.

It sits unseen in the background, quietly reviewing every transaction for signs of fraud, and provides real-time scoring for every incoming payment based on thousands of signals.

Here’s a step-by-step guide on using Radar for blocking prepaid card payments on your website.

What Is Radar for Fraud Teams?

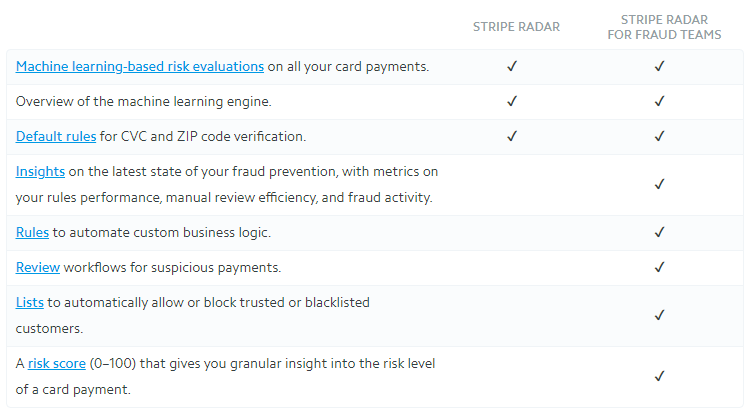

Radar for Fraud Teams is a paid product designed for companies that are especially prone to fraudulent transactions and willing to invest more deeply in protection.

To be clear, Radar for Fraud Teams is a separate product from Radar. Everyone gets Radar, but you have to add Radar for Fraud Teams to your account and pay the additional $0.02 per transaction.

According to Stripe, “Radar for Fraud Teams helps you fine-tune how Radar operates, create custom fraud rules, and optimize manual reviews. See fraud insights, assess rule performance, and view manual review efficiency from a unified dashboard.” It comes with a few unique benefits

- View new types of data related to your payments when you review them to determine if they’re fraud or legitimate.

- Set custom risk thresholds based on a numerical score so you can determine your own fraud comfort.

- Create and maintain lists of attributes (card numbers, IP addresses, emails, etc.) to consistently block and allow.

- View better feedback when you create new rules by seeing how they affect your historical data.

- Look at payments holistically (rather than in isolation) by comparing them to previous related payments that match similar attributes.

- Explore and evaluate your fraud prevention efforts with rich analytics.

Essentially, Radar for Fraud Teams gives you more control over Stripe’s fraud system so you can make changes specific to your business. It’s designed for companies who have special people or teams who prevent and rectify fraudulent activity.

How to Use Stripe Radar

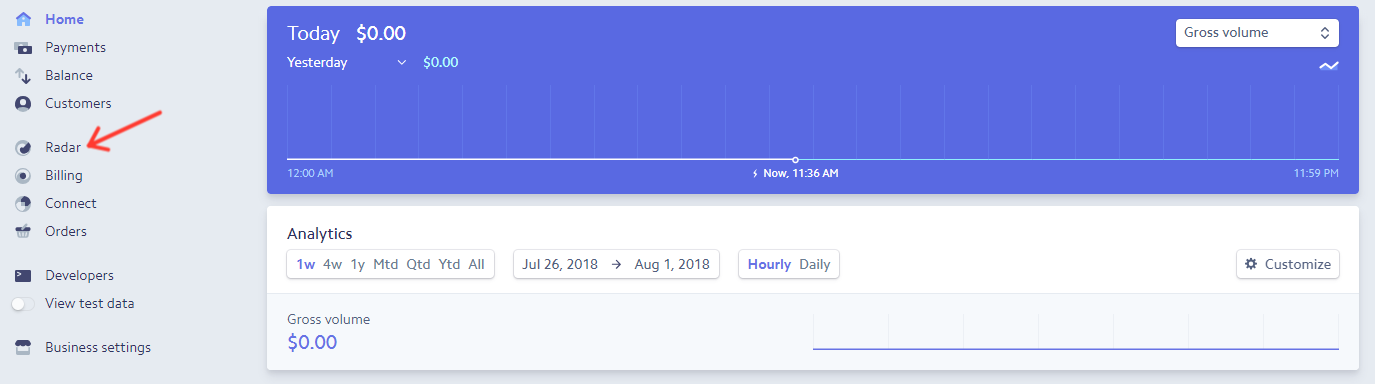

To access Radar, click the menu link on the left side of your Stripe dashboard.

Under that link, three more options will appear.

- Reviews: A prioritized list of payments you need to investigate personally (more on this in a minute).

- Rules: Custom optimizations to Radar for your unique goals.

- Lists: Information used to create your rules (suspicious IP addresses, email addresses of fraudulent customers, etc.). Radar comes with several default lists.

Stripe Radar uses machine learning as part of its fraud detection system, which means it gets smarter over time based on your transaction history and new data from the Stripe team. The purpose is to avoid the “one size fits all” approach to payment processing that most processors offer.

Over time, you’ll want to get the most out of Radar by setting your own rules. By adding rules, you can make some customizations to the tool to support your preferred payment workflow. You can set three types of rules:

Block rules let you block payments you strongly think are fraudulent, even if Radar doesn’t catch them. For instance, you might block payments from a particular country or a type of card.

Allow rules force Stripe to accept payments, even if Stripe Radar might flag them as fraudulent. For example, you might allow all payments from a particular IP address. Allow rules override all other rules including Stripe’s machine learning models, so use these with extreme caution.

Review rules place any qualifying payments into a review queue for you (or someone on your team) to review personally. For instance, you might insist on personally approving all payments over a certain dollar amount.

Protect Yourself From Fraud Payments

Credit card companies have become better at responding to fraud disputes, but it’s still smarter to prevent fraud in the first place. Instead of trying to claw your money back, it’s best to prevent fraudulent transactions before they ever occur.

With a tool like Stripe Radar, you can build your business without worrying about the cost of fraudulent activity.

If you liked this article, you might also want to check out how to block prepaid cards with Stripe Radar.

What are you waiting for? Get started with WP Simple Pay today!

To read more articles like this, follow us on Facebook and Twitter.