5 Best Tax Compliance Plugins and Software for WordPress

By

|

Last updated on

Looking for a tax compliance plugin for WordPress? Tax rules and rates may vary in each and every jurisdiction where you sell your products or where your customers are located globally. As a business owner, you’ll need to stay tax compliant regardless of where you do business.

In this article, we’ll show you some of the best tax compliance plugins and software for WordPress.

Choosing a Tax Compliance Plugin for WordPress

The internet makes it easy to sell your products or services across the globe. Based on where you sell the products and collect the payments from, you might be legally obliged to register with that country or jurisdiction to collect taxes. This is true even if your business has no physical presence in that country or jurisdiction.

To ensure you’re doing business legally around the world, you might need to use a plugin or software that ensures tax compliance.

Choosing the right tax compliance plugin can be tedious since there are tons of plugins and software available on the market. Before choosing a tool, you’ll need to know whether you need to calculate tax automatically based on your customer’s location or if just manual tax collection is enough.

Most small businesses might not need automatic tax calculation and collection tools if their business only sells non-taxable products or sales volume or transactions don’t exceed the tax threshold in a jurisdiction. If you think your business will likely exceed the tax threshold in the near future in any jurisdiction, you can opt for a tool that offers automatic tax calculation.

Now let’s take a look at some of the best WordPress tools for tax collection.

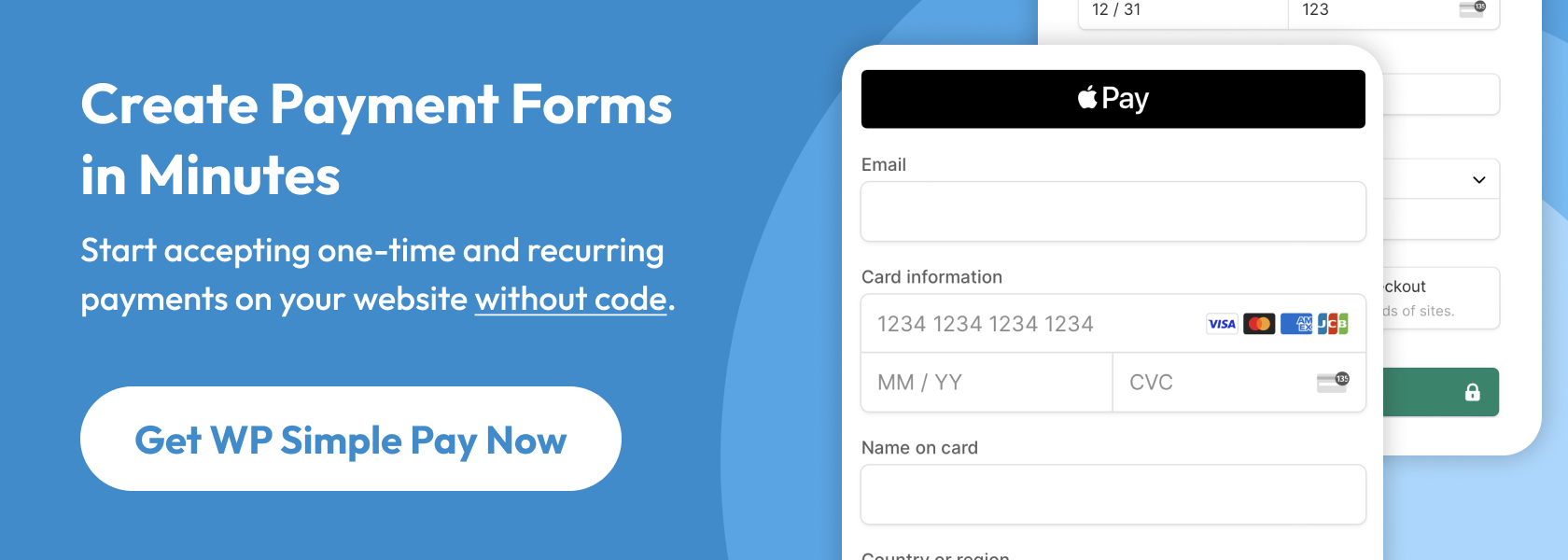

1. WP Simple Pay

WP Simple Pay is the #1 Stripe plugin for WordPress that makes it easy for you to stay tax compliant regardless of where you do business.

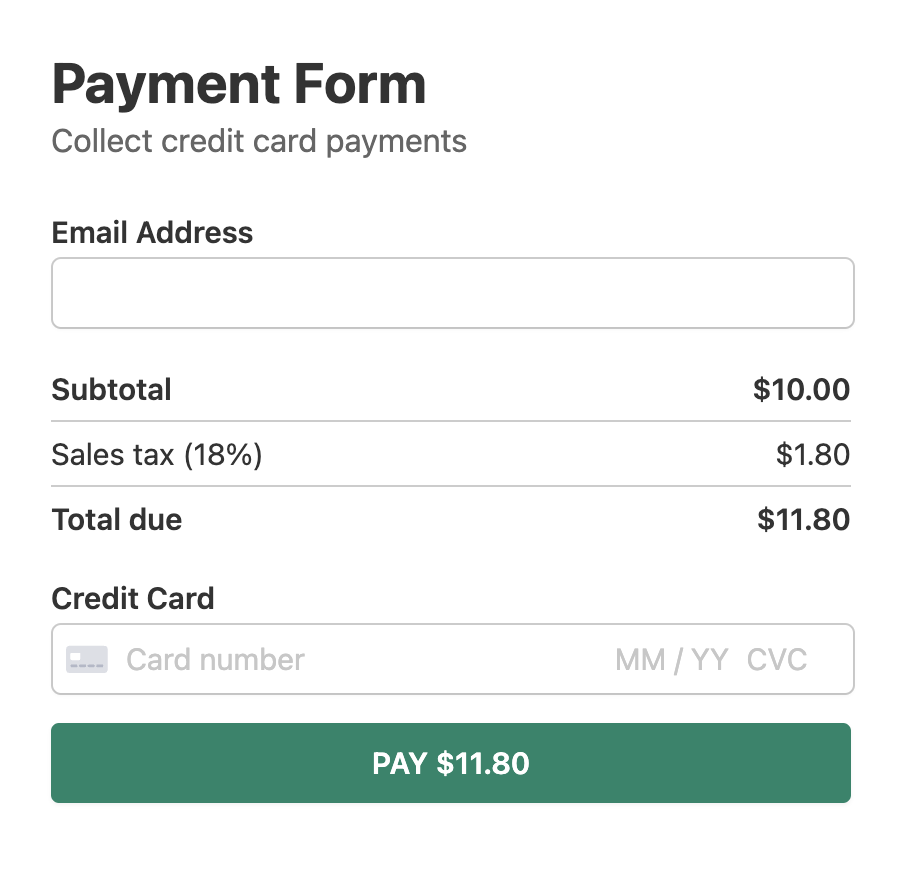

WP Simple Pay lets you collect taxes from your customers in 2 ways:

#1. Fixed Rate Tax Collection (Manual): Define a fixed tax rate (%) and collect it from your customers either inclusively (included in the subtotal) or exclusively (not included in the subtotal) with your payments.

#2. Automatic Tax Collection With Stripe Tax: Stripe Tax is a premium Stripe feature that lets you enable automatic tax collection via your payment forms by monitoring your customers’ precise location.

Automatic tax collection takes a few things into account: your location, the product type you’re selling, and most importantly, your customer’s location, to determine the amount of tax to be charged.

Here’s how WP Simple Pay lets you collect taxes from your customers.

Get started with WP Simple Pay

Pricing: Starts at $49 (A free version is also available with limited features)

2. Easy Digital Downloads

Easy Digital Downloads (EDD) is an eCommerce solution for selling digital products that also lets you collect taxes inclusively or exclusively.

EDD allows you to show tax rates alongside prices, which can be displayed below the purchase buttons. You can also choose to show the tax rate on the checkout page.

Here are a few more Easy Digital Downloads features that help you stay tax compliant.

- Tax rates on regions: Add tax rates for specific countries and/or states/provinces in those countries.

- EDD Invoices: This extension will provide customers with an option to generate and download an invoice that can contain both the store and customer VAT numbers.

- Easy Digital Downloads EU VAT: Another extension that makes it easy for any EDD store to meet European tax law.

- VAT for Easy Digital Downloads: This extension adds complete VAT support to Easy Digital Downloads stores.

Get started with Easy Digital Downloads

Pricing: $99.50 (A free version is also available with limited features)

3. WooCommerce Shipping & Tax

WooCommerce Shipping & Tax is a free addon plugin for WooCommerce, developed by the WooCommerce team. This plugin was previously referred to as WooCommerce Services.

It lets you collect accurate tax at checkout without having to enter tax rates manually.

Keep in mind that in order for this plugin to work, you’ll have to install Jetpack and connect it to your WordPress.com account.

Get Started With WooCommerce Shipping & Tax

Pricing: Free

TaxJar is a Stripe product that lets you stay tax compliant if you’re selling products across multiple channels, like Amazon, and Ebay, in addition to WordPress.

NOTE: If you only sell on your own site, instead of TaxJar, you can use the WP Simple Pay plugin and make use of Stripe Tax, another premium Stripe feature.

TaxJar is built for those who sell products across multiple channels.

The TaxJar platform automates sales tax compliance across 11,000 jurisdictions.

Pricing: Starts at $19 per month

5. Quaderno

Quaderno is a complete tax management platform that is optimized for many platforms, including WordPress-based shopping carts, such as WooCommerce and Easy Digital Downloads. Quaderno’s pricing plans are based on the number of transactions per month.

Below are a few features of Quaderno:

- It takes care of all your tax calculations, letting you know when taxes change, creating reports, and sending tax-compliant invoices.

- Its automated tax reporting lets you file tax returns in just a few minutes, not hours.

- Send localized, tax-compliant invoices and receipts to customers worldwide.

Whether you’re selling with Easy Digital Downloads or WooCommerce on your WordPress site, you can connect Quaderno with them in a single click.

Pricing: Starts at $49 per month, for up to 250 transactions

Verdict: The Best WordPress Tax Compliance Plugin

WP Simple Pay is the best WordPress tax compliance plugin that makes it easy for you to calculate and collect taxes with Stripe. It supports both manual and automatic tax calculation features. It’s also one of the best WordPress Stripe plugins on the market.

Keep in mind that WP Simple Pay is your best bet if you accept payments via payment forms. If you’d want to set up a shopping cart for selling eCommerce digital goods, you might want to use Easy Digital Downloads (EDD) instead.

The best thing about EDD is that it enables you to add tax rates manually for specific countries and/or states/provinces in those countries. That way, you don’t have to pay for expensive subscription-based tax calculation software.

We hope this article helped you learn about the best tax compliance software for WordPress.

If you liked this article, you might also want to check out how to collect tax in WordPress (step by step).

What are you waiting for? Get started with WP Simple Pay today!

To read more articles like this, follow us on Facebook and Twitter.

Leave a Reply